HMRC are actively and strongly encouraging employees to report any suspected National Minimum Wage breaches – make sure you’re getting it right.

SME Business Leaders – Are you paying the correct National Minimum Wage and National Living Wage?

It’s not news that NMW/NLW has increased in April this year. But, it may not be as straightforward to get it right when it comes to paying your staff the correct amounts.

Let’s make sure you’re compliant and not falling foul of the regulations.

Areas to look for

Check more than just the rates of pay to your staff (there are lots of ways you could be underpaying staff)

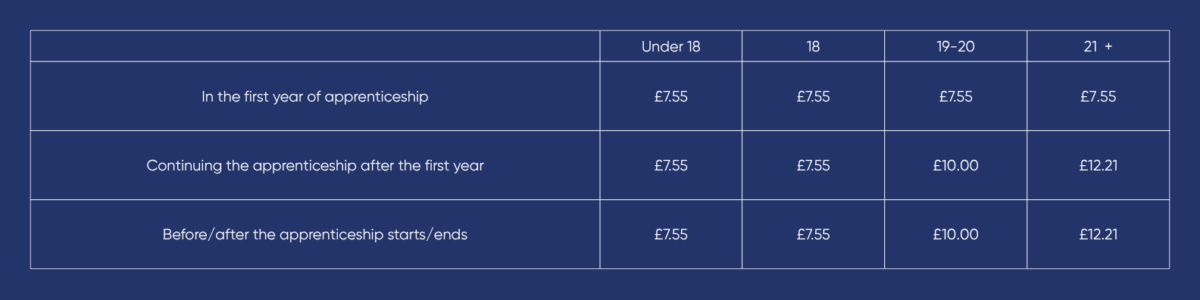

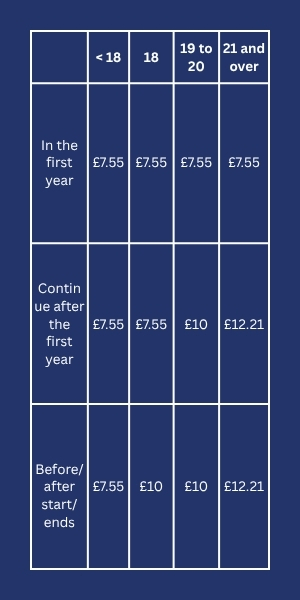

- If you have Apprentices, these are the rates you should be paying, dependent on age and stage of the apprenticeship*:

*This includes paying for time spent training or studying.

- Deductions from pay for items or costs connected with the job

- Areas such as admin fees, uniform, specific clothing or equipment needed for the job

- If you are requiring staff to wear specific uniform or clothing, but you don’t supply these, then this is reducing the minimum wage you pay.

- Deductions of charges for accommodation

- There are very specific rules about the amount you can charge your staff for accommodation. This is called the ‘accommodation off-set’. 2025 rates are £10.66 per day or £74.62 per week.

- If you’re charging your staff more than the off-set rate, then you need to make up the difference in their pay.

- If the charge is at or below the off-set rate, it won’t affect the pay.

- If accommodation is free, then the off-set rate should be added to pay.

- Paying for all the time your staff work. Staff are considered working under the following criteria:

- At work or required to be at work, including time spent carrying out tasks before or after a shift is due to start or end

- Travelling for business or training

- Training, regardless of where this takes place (work, home or somewhere else)

- On standby at or near work

What to do if you think you are underpaying your staff

Your staff have the right to complain to the HMRC if they think they are being underpaid, or they may speak to you directly if they feel confident enough to do so.

Employees can even report businesses if they no longer work there.

Our Employment Law team are on hand to support, guide and offer advice in relation NMW/NLW or NI contributions. It’s better to be compliant and continue to build trust with your employees, than risk legal and reputational damage.